indiana real estate taxes

It looks like something has gone wrong. 1 an amount equal to the percentage change in the consumer price index for the prior calendar year.

/gettyimages-1299026418-1024x1024-53a7a37a410d4c749c0060f7bcc7f813.jpeg)

Real Estate Taxes Vs Personal Property Taxes

Property tax payments are made to your county treasurer.

. Deductions work by reducing the amount of assessed value a taxpayer pays on a given parcel of property. View and print Assessed Values including Property Record Cards. Enter your last name first initial.

The state of Indiana provides two types of senior citizens property tax exemptions. Main Street Crown Point IN 46307 Phone. Choose from the options below.

View and print Tax Statements and Comparison Reports. For contact information visit. Over 65 Tax Deduction.

Indiana Career Connect. Make and view Tax Payments get current Balance Due. Criminal Justice Institute.

Monday - Friday 800 am. Property Tax Due Dates. ADA Title VI.

Over 65 Tax Credit. May 13SOUTHERN INDIANA Southern Indiana residents can expect increases in their property tax assessments next year as long as Indiana housing marketing. Provides that for each calendar year beginning after December 31 2021 an annual adjustment of the assessed value of certain real property must not exceed the lesser of.

A homeowner with a median Indiana home value of 144600 will pay 1436 0993 annually in Hamilton County versus 753 0521 in Orange County. Corrections Indiana Department of. Please contact the Indiana Department of Revenue at 317 232-1497.

Joseph County Tax research information. Transaction Fees are Non-Refundable. You can search the propertyproperties by.

The Department of Local Government Finance has compiled this information in an easy-to-use format to assist Hoosiers in obtaining information about property taxes. The information provided in these databases is public record and available through public information requests. Building A 2nd Floor 2293 N.

Our property records tool can return a variety of information about your property that affect your property tax. Tax amount varies by county. But dont worry were working to get it back on track.

View Ownership Information including Property Deductions and Transfer History. Your total payment including the credit card online transaction fee will be calculated and displayed prior to the completion of your transaction. You will receive a statement with upcoming due dates in the Spring.

Tips for Your Job Search. Application for deductions must be completed and dated not later than December 31 annually. Room 109 Anderson IN 46016 765 641-9645 Madison County Treasurers Office 16 E 9th St.

Jobs Marketplace. The table below shows the details of both programs. Law Enforcement Academy Indiana.

Taxpayers do not need to reapply for deductions annually. Search by address Search by parcel number. Property tax increase limits.

Indiana has relatively low property taxes. Room 109 Anderson IN 46016 765 641-9645. Use this application to.

In Indiana aircraft are subject to the aircraft excise tax and registration fee that is in lieu of the ad valorem property tax levied for state or local purposes Indiana Code 6-6-65. Since the information displayed appears exactly as it. State Excise Police Indiana.

Welcome to the St. The transaction fee is 25 of the total balance due. Disclaimer Madison County Treasurers Office 16 E 9th St.

Over 65 Tax Creditor Over 65 Circuit Border. Possible extended hours for tax deadlines will be posted closer to time. Hancock County Treasurer.

Or 2 an amount equal to 3 over. Search for your property. Counties in Indiana collect an average of 085 of a propertys assesed fair market value as property tax per year.

This is around half the national average. May 12 2022 901 PM 2 min read. The amount youll pay in property taxes varies depending on where you live and how much your home is worth but the statewide average effective property tax rate is 081.

Current property tax due dates are. The median property tax in Indiana is 105100 per year for a home worth the median value of 12310000. Please note there is a nomimal convenience fee charged for these services.

These fees are not retained by Lake County and therefore are not refundable. The Property Tax Portal will assist you in finding the most frequently requested information about your property taxes. As part of our commitment to provide our customers with efficient and convenient service The Treasurers Office now offers tax payments over the Internet using major credit cards and e-checks.

Property taxes are due twice a year. Use our free Indiana property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent assessment and local property tax statistics. Court House 101 S Main Street New Castle IN 47362 Justice Center 1215 Race Street New Castle IN 47362 Henry County Office Building 1201 Race Street.

The applicant needs to be an Indiana citizen. In fact the average annual property tax paid in Indiana is just 1263. Indiana capps property tax rates at 1 of the value for residential property 2 of the value for rental property and farmland and 3 of the value for all other types.

If you are having trouble searching please visit Assessor Property Cards to lookup the address and parcel number. Enter the number and a few letters of the remaining address if the property is not found shorten up on the criteria you entered. Homeland Security Department of.

124 Main rather than 124 Main Street or Doe rather than John Doe. Property Reports and Tax Payments. National Guard Indiana.

Reapplication should only occur if the property is sold the title. 155 Indiana Avenue Valparaiso Indiana 46383 Phone. Over 65 Tax Deduction.

Please direct all questions and form requests to the above agency. This search may take over three 3 minutes. Number is located on the left corner of your.

For best search results enter a partial street name and partial owner name ie. American Legion Place Suite 205.

Property Tax Rates Across The State

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Property Taxes By State County Lowest Property Taxes In The Us Mapped

The Ultimate Guide To Indiana Real Estate Taxes

Property Tax Rates Across The State

How We Got Here From There A Chronology Of Indiana Property Tax Laws

Indiana Property Tax Calculator Smartasset

The New Age In Indiana Property Tax Assessment

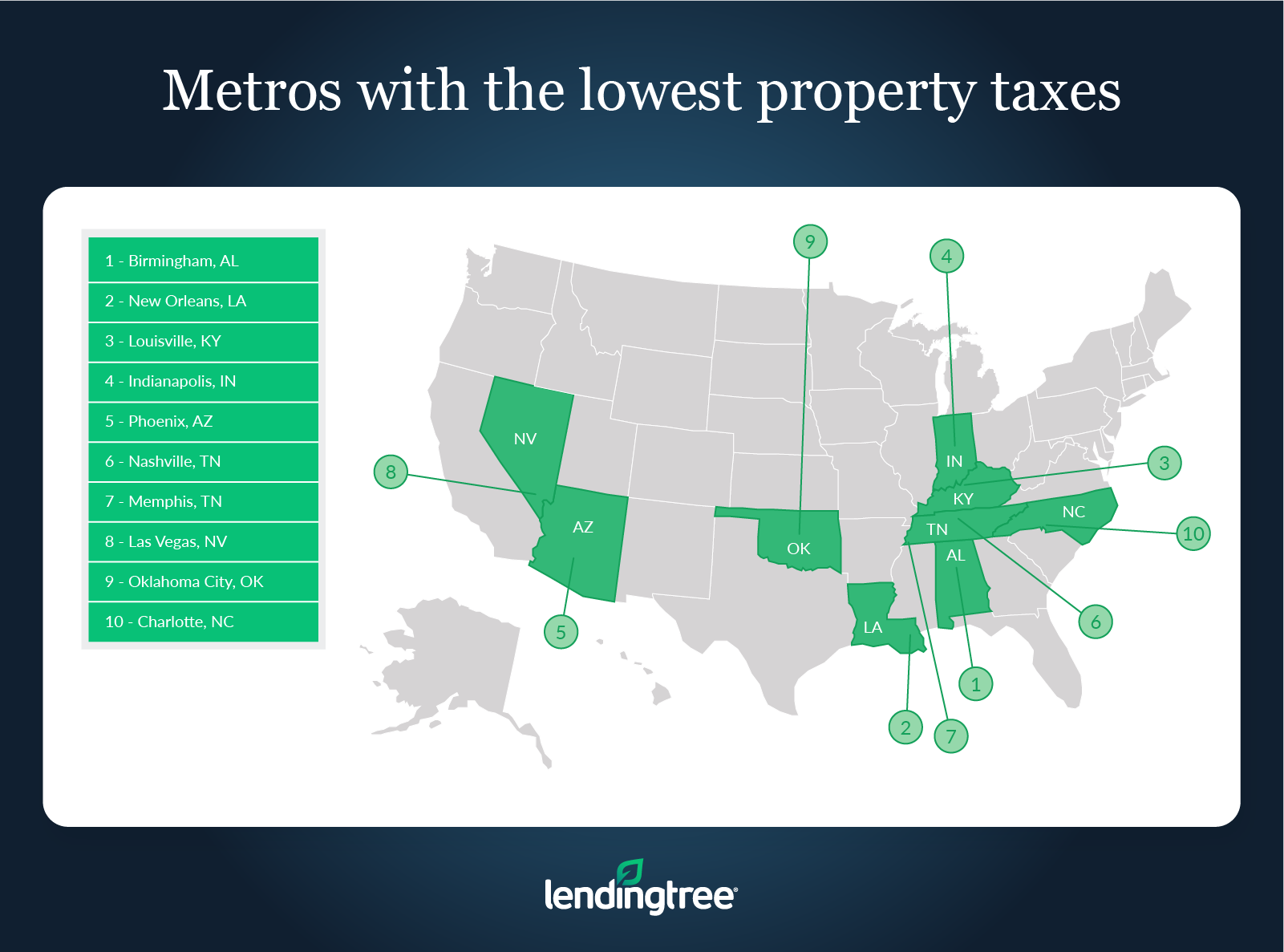

Where People Pay Lowest Highest Property Taxes Lendingtree

The New Age In Indiana Property Tax Assessment

How To Read Your Property Tax Bill Community Development

The New Age In Indiana Property Tax Assessment

Indiana County Assessors Association Serving Our Counties With Pride

Property Tax Prorations Case Escrow